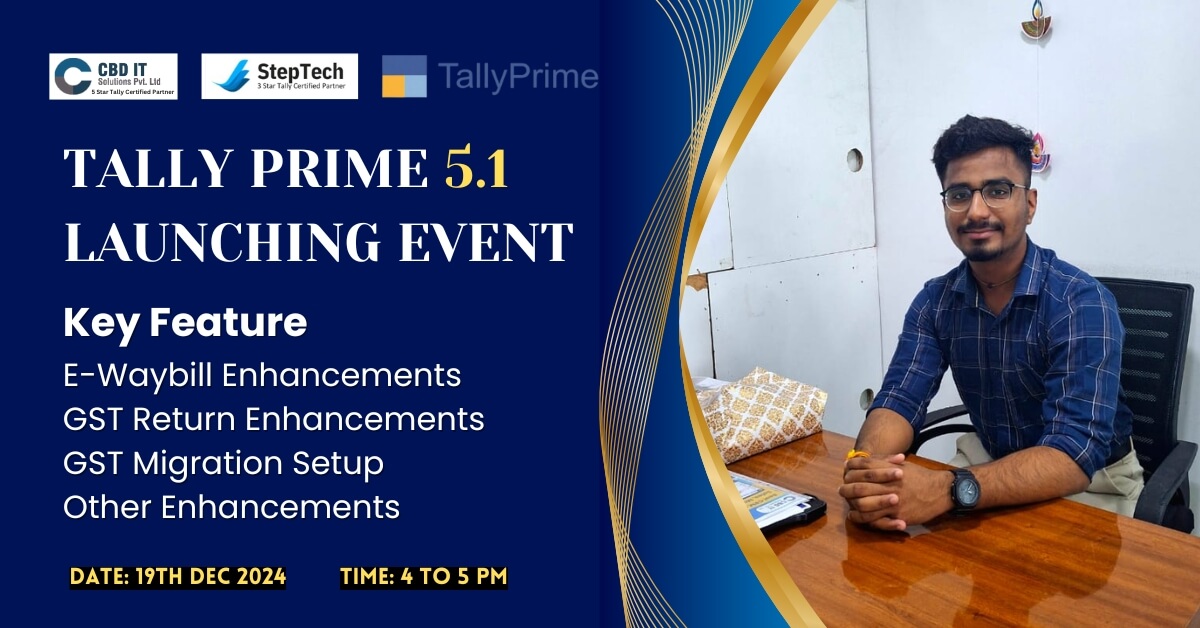

Tally Prime 5.1 Launching Event

“TallyPrime has made a notable stride in simplifying compliance by introducing advanced improvements to GST and eWay bill management, ensuring both precision and adaptability.”

E-Waybill Enhancements

Businesses currently need to manually input details in the e-Way bill sub-form for accurate printing. TallyPrime eliminates this hassle with its latest update, automatically calculating pin-to-pin distances for precise results, seamless operations, and time savings.

For businesses with constant material movement, adhering to e-Way bill protocols is essential. TallyPrime simplifies compliance for both inbound and outbound transactions, ensuring smooth operations for job workers.

TallyPrime enables businesses to generate e-Way bills for export invoices with accurate State and Pin codes, ensuring seamless operations.

GST Return Enhancements

TallyPrime's update gives users more control over GST compliance by preventing automatic re-computation from master data changes. Users can now update GST statuses for vouchers only when necessary.

TallyPrime simplifies handling invalid GSTINs with a bulk conversion feature, enabling quick B2B to B2C invoice conversions for transactions with inactive GSTINs.

TallyPrime now allows businesses to export annual GSTR-1 returns for any period, whether monthly or quarterly. In line with regulatory updates, TallyPrime now supports the latest GSTR-2B API Version 4.

GST Migration Setup

The migration process is now more adaptable, allowing users to customize settings to suit their business requirements.

Flexible voucher numbering: During migration, users can choose to keep the current voucher numbering or opt for renumbering, allowing them to align with their business needs while maintaining convenience.

HSN applicability setup:On migration, users have the option to configure HSN summary for B2C transactions or all sections as necessary. Additionally, they can set the HSN length to 4, 6, or 8 digits, ensuring transactions are categorized as ‘Included’ or ‘Uncertain’ according to their specific needs.

Other Enhancements

Transactions marked as "Accepted As Is" or "Ignore Validation" will now stay "Included" unless there's a change in their GST details. Previously, such transactions were marked as "Uncertain" upon being resaved, regardless of whether returns were filed or signed. The latest update ensures these transactions remain consistent, eliminating the need to recheck past returns and making the process more efficient

Conclusion

TallyPrime’s latest updates are crafted to streamline GST processes, giving users greater control and improving efficiency. With improvements such as bulk invoice conversion and quicker calculations, these changes ensure a more efficient and hassle-free GST experience for businesses..

Customized solutions of CBD IT

Our team exemplifies brilliance in distinct industries using flexible and customized solutions. We adhere to Provide excellent quality and timely services to all our clients effectively and efficiently. We keenly focus on customer satisfaction and the service we are providing.

- Party wise pervious balance

- HSN & GST rate in columnar

- Stamp & sign

- Auto mail outstanding

- Auto mail sales register & voucher

- Master import

- Bank statement import

- Scheduler Auto backup

- Cost Center wise P & L Balance sheet

- MSME number in sales invoice

To know more details CLICK HERE